Tax Brackets Korea . as mentioned, korea imposes a local income tax of 10% on the calculated national income tax. review the latest income tax rates, thresholds and personal allowances in south korea which are used to calculate salary after tax when factoring in social. The growth rate declined to 2.6% in 2022 and is estimated to further. understanding korea’s income tax brackets is essential for individuals to calculate their tax liability accurately. during 2021, the korean economy recorded a growth rate of 4.1%. korea has a bracketed income tax system with four income tax brackets, ranging from a low of 6.00% for those earning under. a foreign expatriate or employee can choose the 19% flat tax rate as a monthly employment income.

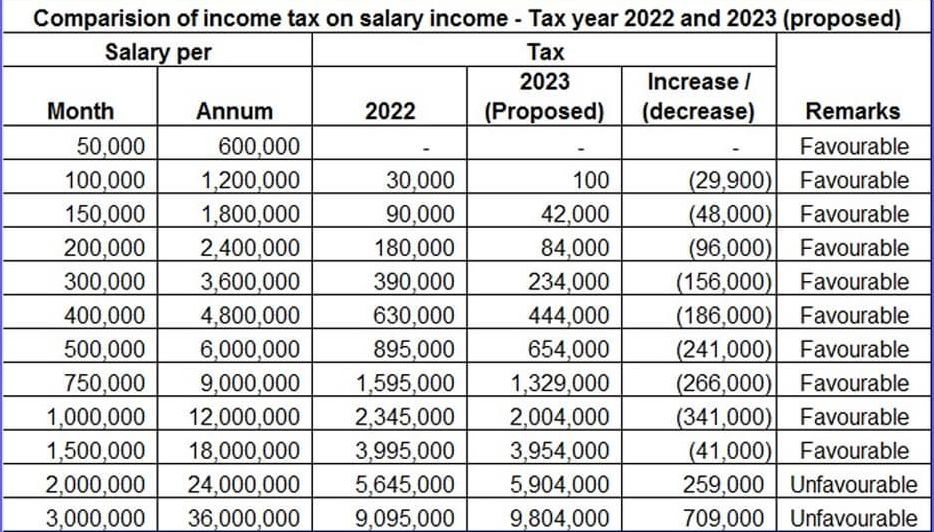

from propakistani.pk

review the latest income tax rates, thresholds and personal allowances in south korea which are used to calculate salary after tax when factoring in social. understanding korea’s income tax brackets is essential for individuals to calculate their tax liability accurately. during 2021, the korean economy recorded a growth rate of 4.1%. korea has a bracketed income tax system with four income tax brackets, ranging from a low of 6.00% for those earning under. The growth rate declined to 2.6% in 2022 and is estimated to further. a foreign expatriate or employee can choose the 19% flat tax rate as a monthly employment income. as mentioned, korea imposes a local income tax of 10% on the calculated national income tax.

New Tax Slabs Introduced for Salaried Class in Budget 202223

Tax Brackets Korea korea has a bracketed income tax system with four income tax brackets, ranging from a low of 6.00% for those earning under. understanding korea’s income tax brackets is essential for individuals to calculate their tax liability accurately. The growth rate declined to 2.6% in 2022 and is estimated to further. korea has a bracketed income tax system with four income tax brackets, ranging from a low of 6.00% for those earning under. review the latest income tax rates, thresholds and personal allowances in south korea which are used to calculate salary after tax when factoring in social. during 2021, the korean economy recorded a growth rate of 4.1%. as mentioned, korea imposes a local income tax of 10% on the calculated national income tax. a foreign expatriate or employee can choose the 19% flat tax rate as a monthly employment income.

From propakistani.pk

New Tax Slabs Introduced for Salaried Class in Budget 202223 Tax Brackets Korea korea has a bracketed income tax system with four income tax brackets, ranging from a low of 6.00% for those earning under. a foreign expatriate or employee can choose the 19% flat tax rate as a monthly employment income. as mentioned, korea imposes a local income tax of 10% on the calculated national income tax. during. Tax Brackets Korea.

From debqdoralyn.pages.dev

Irs Tax Brackets 2024 Calculator Hatty Kordula Tax Brackets Korea during 2021, the korean economy recorded a growth rate of 4.1%. understanding korea’s income tax brackets is essential for individuals to calculate their tax liability accurately. a foreign expatriate or employee can choose the 19% flat tax rate as a monthly employment income. as mentioned, korea imposes a local income tax of 10% on the calculated. Tax Brackets Korea.

From taxpm.com

2018 Tax Brackets TaxPM™ Tax Brackets Korea review the latest income tax rates, thresholds and personal allowances in south korea which are used to calculate salary after tax when factoring in social. as mentioned, korea imposes a local income tax of 10% on the calculated national income tax. understanding korea’s income tax brackets is essential for individuals to calculate their tax liability accurately. . Tax Brackets Korea.

From periaykathleen.pages.dev

What Are The New Tax Brackets For 2024 Uk Gustie Xylina Tax Brackets Korea korea has a bracketed income tax system with four income tax brackets, ranging from a low of 6.00% for those earning under. The growth rate declined to 2.6% in 2022 and is estimated to further. review the latest income tax rates, thresholds and personal allowances in south korea which are used to calculate salary after tax when factoring. Tax Brackets Korea.

From www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know Tax Brackets Korea during 2021, the korean economy recorded a growth rate of 4.1%. understanding korea’s income tax brackets is essential for individuals to calculate their tax liability accurately. review the latest income tax rates, thresholds and personal allowances in south korea which are used to calculate salary after tax when factoring in social. a foreign expatriate or employee. Tax Brackets Korea.

From www.wgrz.com

IRS changing tax brackets, standard deductions going up in 2023 Tax Brackets Korea The growth rate declined to 2.6% in 2022 and is estimated to further. understanding korea’s income tax brackets is essential for individuals to calculate their tax liability accurately. a foreign expatriate or employee can choose the 19% flat tax rate as a monthly employment income. during 2021, the korean economy recorded a growth rate of 4.1%. . Tax Brackets Korea.

From www.financestrategists.com

Taxes Ultimate Guide Tax Brackets, How to File and How to Save Tax Brackets Korea during 2021, the korean economy recorded a growth rate of 4.1%. korea has a bracketed income tax system with four income tax brackets, ranging from a low of 6.00% for those earning under. a foreign expatriate or employee can choose the 19% flat tax rate as a monthly employment income. review the latest income tax rates,. Tax Brackets Korea.

From koreasolved.com

Tax Brackets In Korea Explained [June 2024 Update] Tax Brackets Korea korea has a bracketed income tax system with four income tax brackets, ranging from a low of 6.00% for those earning under. The growth rate declined to 2.6% in 2022 and is estimated to further. a foreign expatriate or employee can choose the 19% flat tax rate as a monthly employment income. during 2021, the korean economy. Tax Brackets Korea.

From www.connerash.com

2023 Tax Brackets and Other Adjustments Conner Ash Tax Brackets Korea understanding korea’s income tax brackets is essential for individuals to calculate their tax liability accurately. The growth rate declined to 2.6% in 2022 and is estimated to further. during 2021, the korean economy recorded a growth rate of 4.1%. review the latest income tax rates, thresholds and personal allowances in south korea which are used to calculate. Tax Brackets Korea.

From www.koreantaxblog.com

Tax Invoice(세금계산서) Korean tax blog authored by jz associate Tax Brackets Korea The growth rate declined to 2.6% in 2022 and is estimated to further. understanding korea’s income tax brackets is essential for individuals to calculate their tax liability accurately. review the latest income tax rates, thresholds and personal allowances in south korea which are used to calculate salary after tax when factoring in social. a foreign expatriate or. Tax Brackets Korea.

From blog.turbotax.intuit.com

What is a Tax Bracket? The TurboTax Blog Tax Brackets Korea as mentioned, korea imposes a local income tax of 10% on the calculated national income tax. review the latest income tax rates, thresholds and personal allowances in south korea which are used to calculate salary after tax when factoring in social. The growth rate declined to 2.6% in 2022 and is estimated to further. during 2021, the. Tax Brackets Korea.

From koreantaxexpert.com

2023 Korean Corporate Tax Brackets Tax Brackets Korea a foreign expatriate or employee can choose the 19% flat tax rate as a monthly employment income. The growth rate declined to 2.6% in 2022 and is estimated to further. understanding korea’s income tax brackets is essential for individuals to calculate their tax liability accurately. korea has a bracketed income tax system with four income tax brackets,. Tax Brackets Korea.

From www.ntu.org

Tax Brackets for 2021 and 2022 Publications National Tax Brackets Korea korea has a bracketed income tax system with four income tax brackets, ranging from a low of 6.00% for those earning under. understanding korea’s income tax brackets is essential for individuals to calculate their tax liability accurately. as mentioned, korea imposes a local income tax of 10% on the calculated national income tax. during 2021, the. Tax Brackets Korea.

From taxedright.com

IRS Tax Brackets for 2023 Taxed Right Tax Brackets Korea during 2021, the korean economy recorded a growth rate of 4.1%. review the latest income tax rates, thresholds and personal allowances in south korea which are used to calculate salary after tax when factoring in social. as mentioned, korea imposes a local income tax of 10% on the calculated national income tax. understanding korea’s income tax. Tax Brackets Korea.

From imaa-institute.org

Taxation Of CrossBorder Mergers And Acquisitions Korea 2014 Imaa Tax Brackets Korea during 2021, the korean economy recorded a growth rate of 4.1%. korea has a bracketed income tax system with four income tax brackets, ranging from a low of 6.00% for those earning under. understanding korea’s income tax brackets is essential for individuals to calculate their tax liability accurately. review the latest income tax rates, thresholds and. Tax Brackets Korea.

From www.koreaners.com

Koreaners Tax Brackets Korea a foreign expatriate or employee can choose the 19% flat tax rate as a monthly employment income. The growth rate declined to 2.6% in 2022 and is estimated to further. during 2021, the korean economy recorded a growth rate of 4.1%. as mentioned, korea imposes a local income tax of 10% on the calculated national income tax.. Tax Brackets Korea.

From blog.turbotax.intuit.com

What is a Tax Bracket? The TurboTax Blog Tax Brackets Korea The growth rate declined to 2.6% in 2022 and is estimated to further. korea has a bracketed income tax system with four income tax brackets, ranging from a low of 6.00% for those earning under. during 2021, the korean economy recorded a growth rate of 4.1%. review the latest income tax rates, thresholds and personal allowances in. Tax Brackets Korea.

From fortwoplz.com

Claiming a Tax Refund in Korea A MustKnow for Savvy Travelers For Tax Brackets Korea a foreign expatriate or employee can choose the 19% flat tax rate as a monthly employment income. during 2021, the korean economy recorded a growth rate of 4.1%. korea has a bracketed income tax system with four income tax brackets, ranging from a low of 6.00% for those earning under. understanding korea’s income tax brackets is. Tax Brackets Korea.